Project: Ed (End-to-End)

Role:

Sole Researcher & Designer for the End-to-End Product

Overview:

Project: Ed sought to address the growing demand within the thriving anime community for trustworthy recommendations of similar shows. This was achieved by leveraging the extensive database of MyAnimeList (MAL), a widely popular platform and hub for anime enthusiasts.

All deliverables were presented to an acting stakeholder.

(Not an official partnership with MyAnimeList, used for a class project)

Background

Problem:

I have noticed that not only newcomers to the genre, but even decade-long watchers (like myself), still have trouble searching for alike anime. No one should have to spend hours—or even days—searching through comment sections to find their perfect niche show.

Goals:

(1) Develop an application that can accurately recommend similar anime based on the user's chosen criteria.

(2) Determine if the existence of this app is warranted based on the current need.

(3) Develop a Wizard of Oz prototype that curates user reviews from MAL’s robust database to recommend appropriate anime based on criteria.

Research Plan Check-it-Out

A research plan was delivered to the acting stakeholder detailing goals, the research question, hypotheses, methods for data collection, methodology, participation standards, and proposed survey and interview items.

Hypotheses:

Hypothesis 1:

Experienced users may not need a curated anime app unlike newer members of the media but both types of users will have a demand for it.

Experienced users may not need a curated anime app unlike newer members of the media but both types of users will have a demand for it.

Hypothesis 2:

Users of MAL would prefer a curated application reliant on other lay users like them instead of professional critics.

Users of MAL would prefer a curated application reliant on other lay users like them instead of professional critics.

Hypothesis 3:

Unless the fee was very minimal ($1-2/mo) potential customers would be highly discouraged from using the application.

Unless the fee was very minimal ($1-2/mo) potential customers would be highly discouraged from using the application.

Hypothesis 4:

Members would actively contribute to reviews if the app benefits them and the community.

Members would actively contribute to reviews if the app benefits them and the community.

Methodology:

Competitive Analysis:

A competitive analysis based on secondary research for 5 different companies.

Evaluating Hypotheses 1, 2, & 4:

Exploratory interviews, Qualtrics Survey

Evaluating Hypotheses 3:

Van Westendorp Price Analysis

Prototype Testing & Improvements:

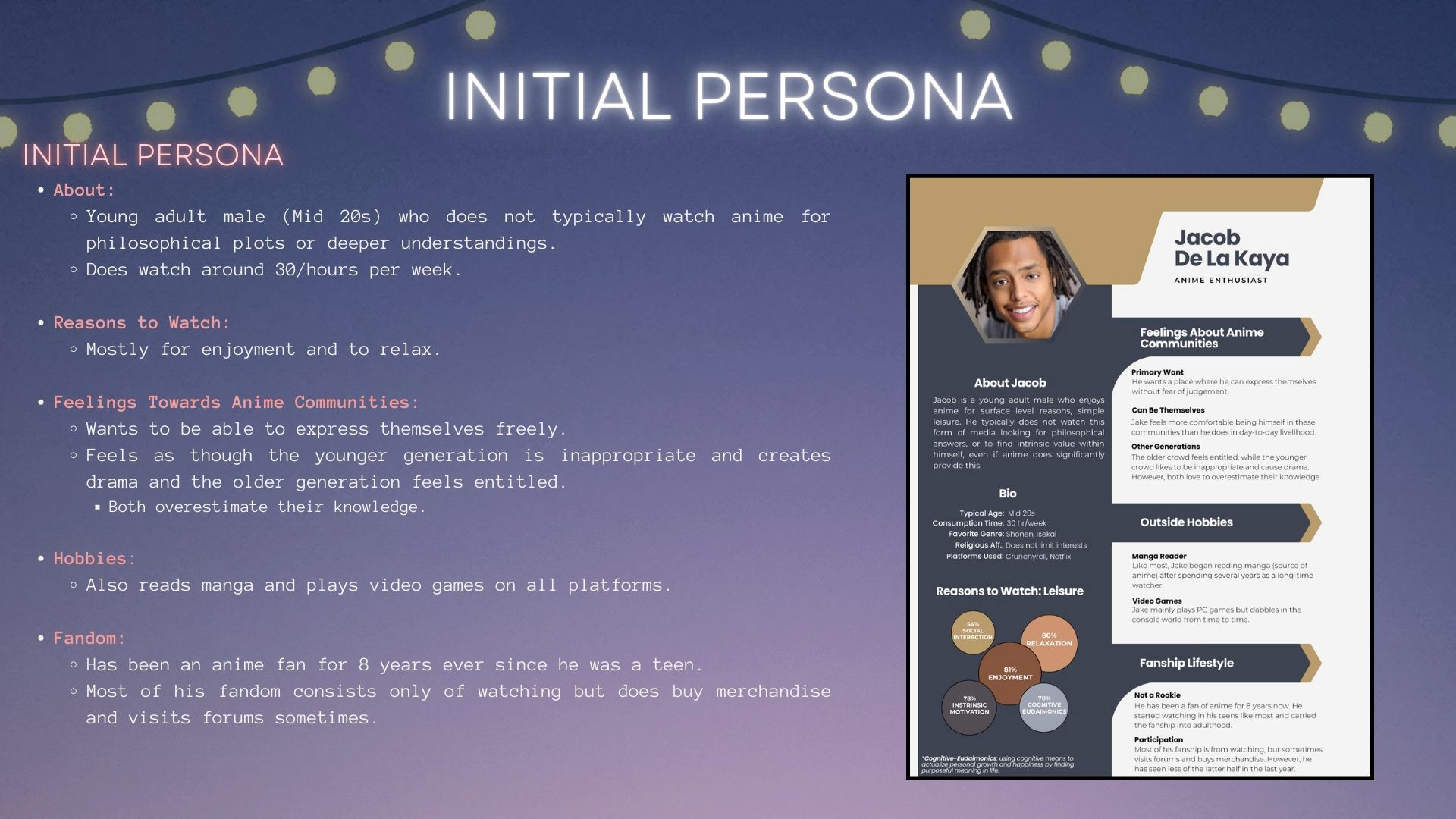

Development of a Proto Persona, 'Mid-Fi' prototype, Moderated Demonstration

Timeline Check-it-Out

About:

Young adult male (Mid 20s) who does not typically watch anime for philosophical plots or deeper understandings but for enjoyment and relaxation.

Does watch around 30/hours per week.

Feelings Towards Anime Community:

They want to express themselves freely.

Thinks the younger generation is inappropriate and creates drama and the older generation feels entitled. However, both overestimate their knowledge.

Hobbies & Fandom:

Reads manga and plays video games on all platforms.

Has been an anime fan for 8 years ever since he was a teen.

Most of his fandom consists only of watching but does buy merchandise and visits forums sometimes.

Competitive Analysis

Overview:

Top App Competitors:

No curated anime application of note.

Used top competitors for MAL that could launch a similar product.

Companies (5 total): AniDB, AniList, Anime-Planet, Kitsu, MangaDex

MyAnimeList (Self-Analysis):

Highest organic monthly traffic, 2nd lowest Bounce Rate, similar country distributions, similar pricing options

Assessed Characteristics (9 total):

- Country Dist., Direct/Indirect Competition, Organic Search Traffic, Price of Services, Top 2 Keywords by Intent, Average Visit Duration, Pages per Visit, Bounce Rate, and any other notable information.

(All metrics were assessed using Semrush)

Notable Industry Concern for Each:

AniDB: Outdated interface but provides the similar features

AniList: ‘Next-gen’ but no clear difference between others.

Anime-Planet: Imbedded watching for premium users.

Kitsu: Can import MAL or AniList data.

MangaDex: Imbedded reading for manga.

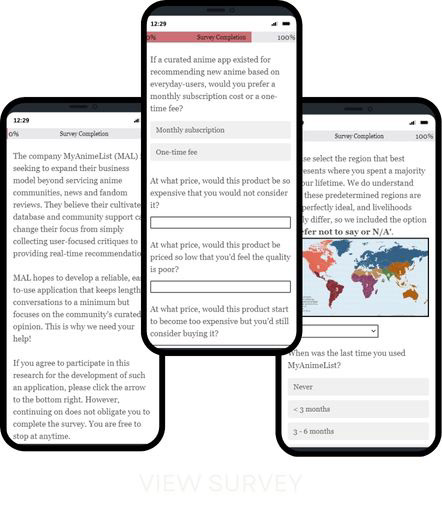

Survey Insights Check-Out-the-Demo

Design:

Sample size n = 16.

Questions (17 total):

8 x Multiple choice

4 x Likert 7-Point scale questions

5 x Van Westendorp Price Analysis questions

Question Category:

Questions1, 4, 7, 12: Demographics & Anime Lifestyle

Questions 5, 6, 8: Searching & Choosing Anime

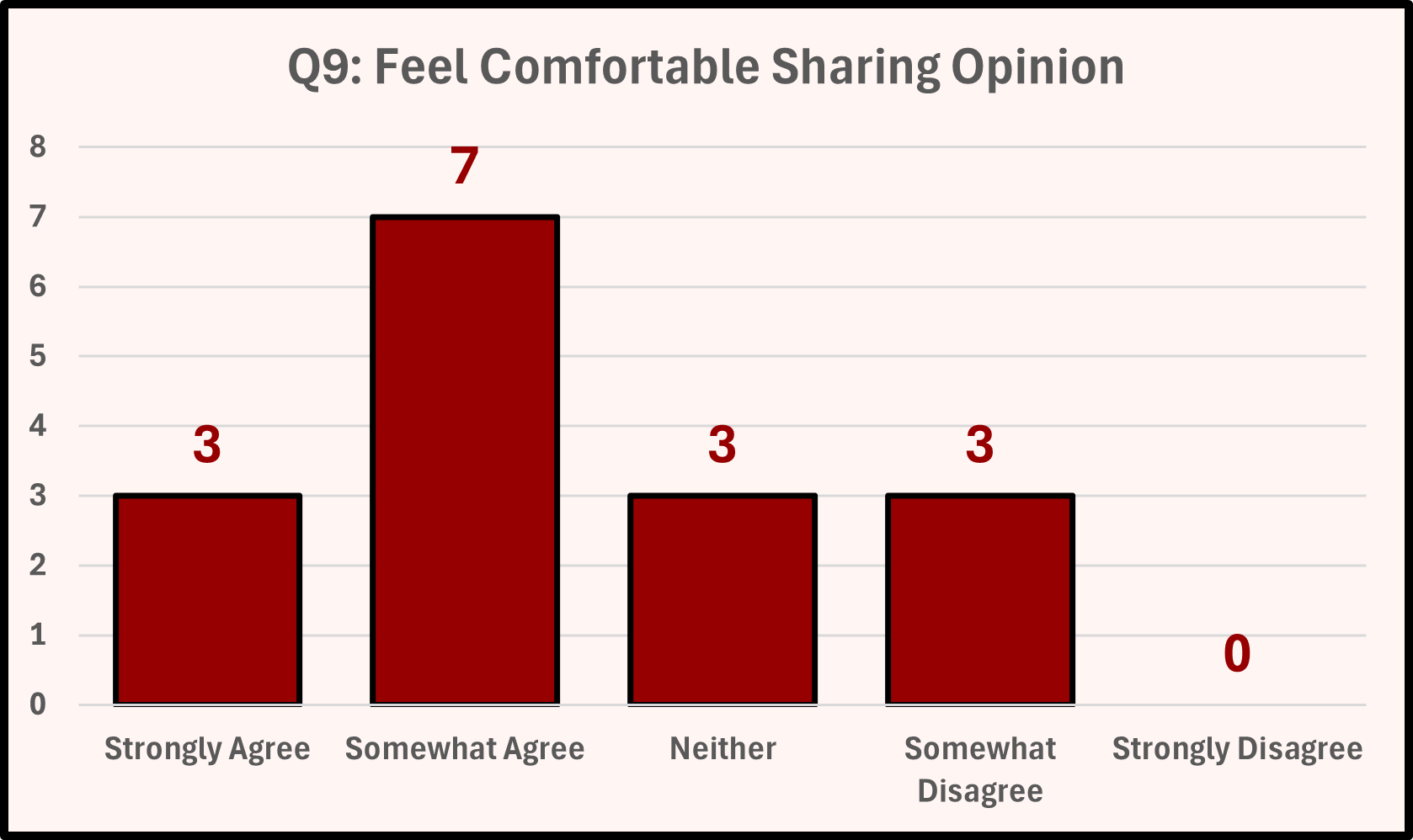

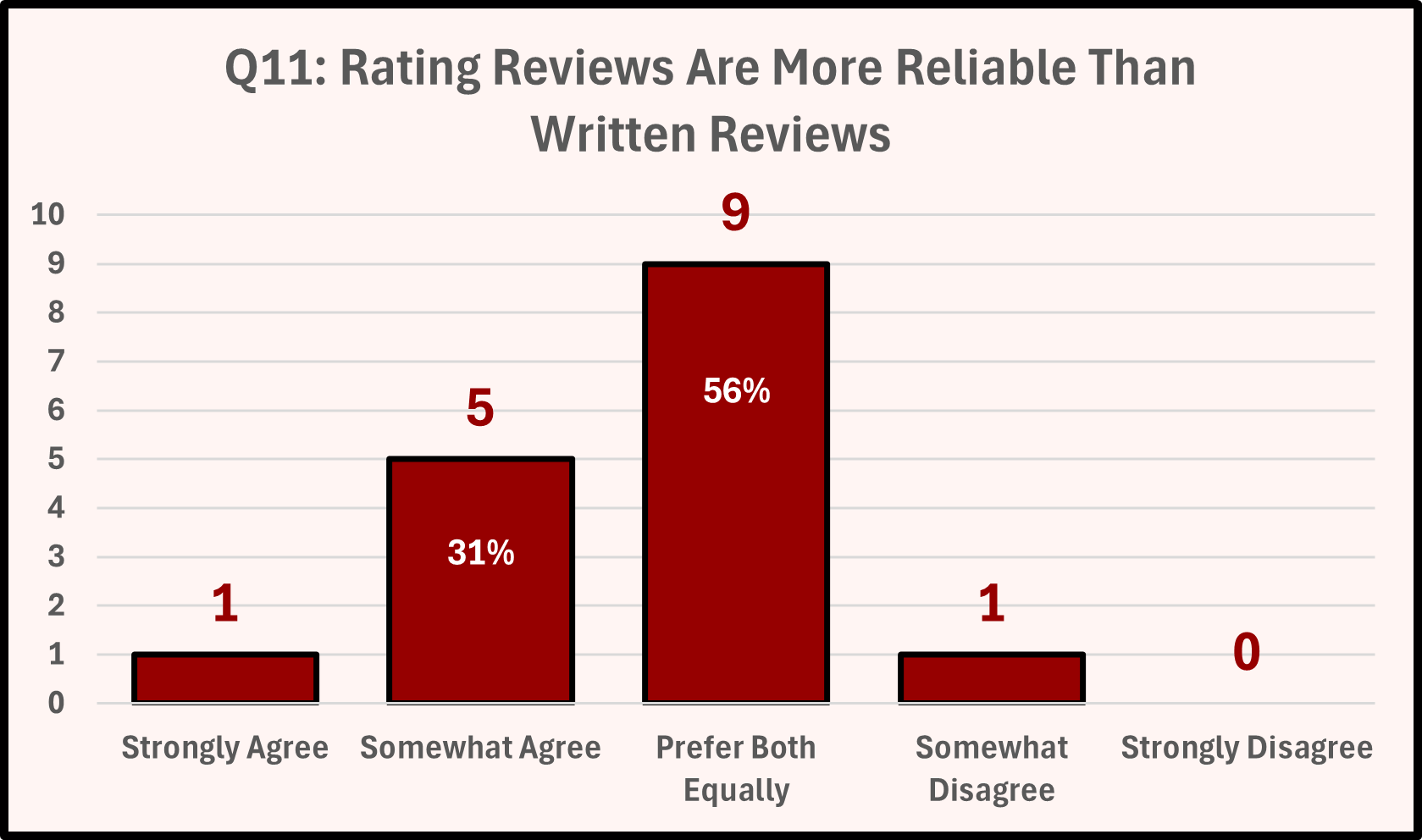

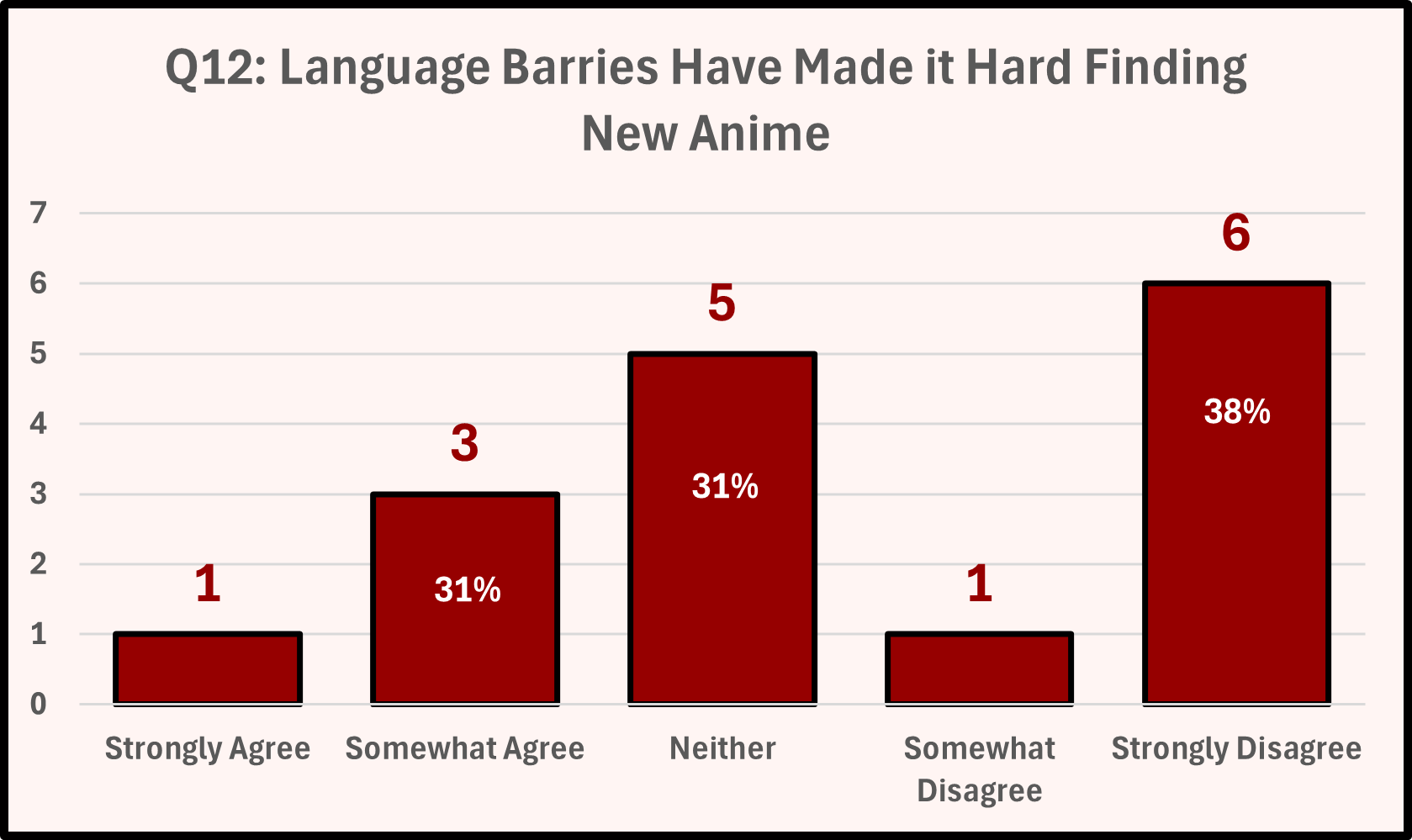

Questions 2, 3, 9, 10, 11: Community Lifestyle

Questions 13-17: Price Analysis

Notable Results:

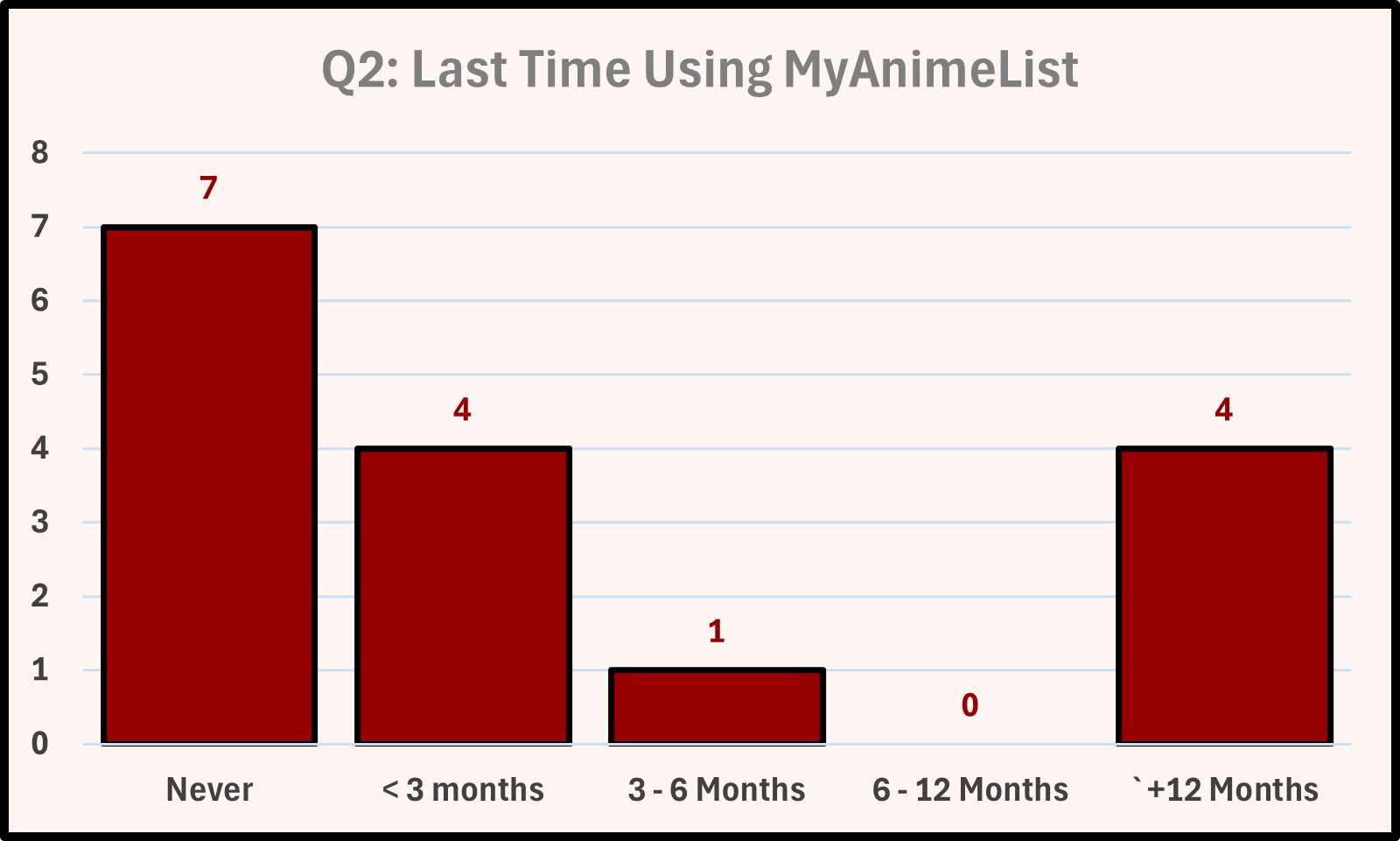

Question 2: 43% of participants have never used MAL, and 24% have not in the last year.

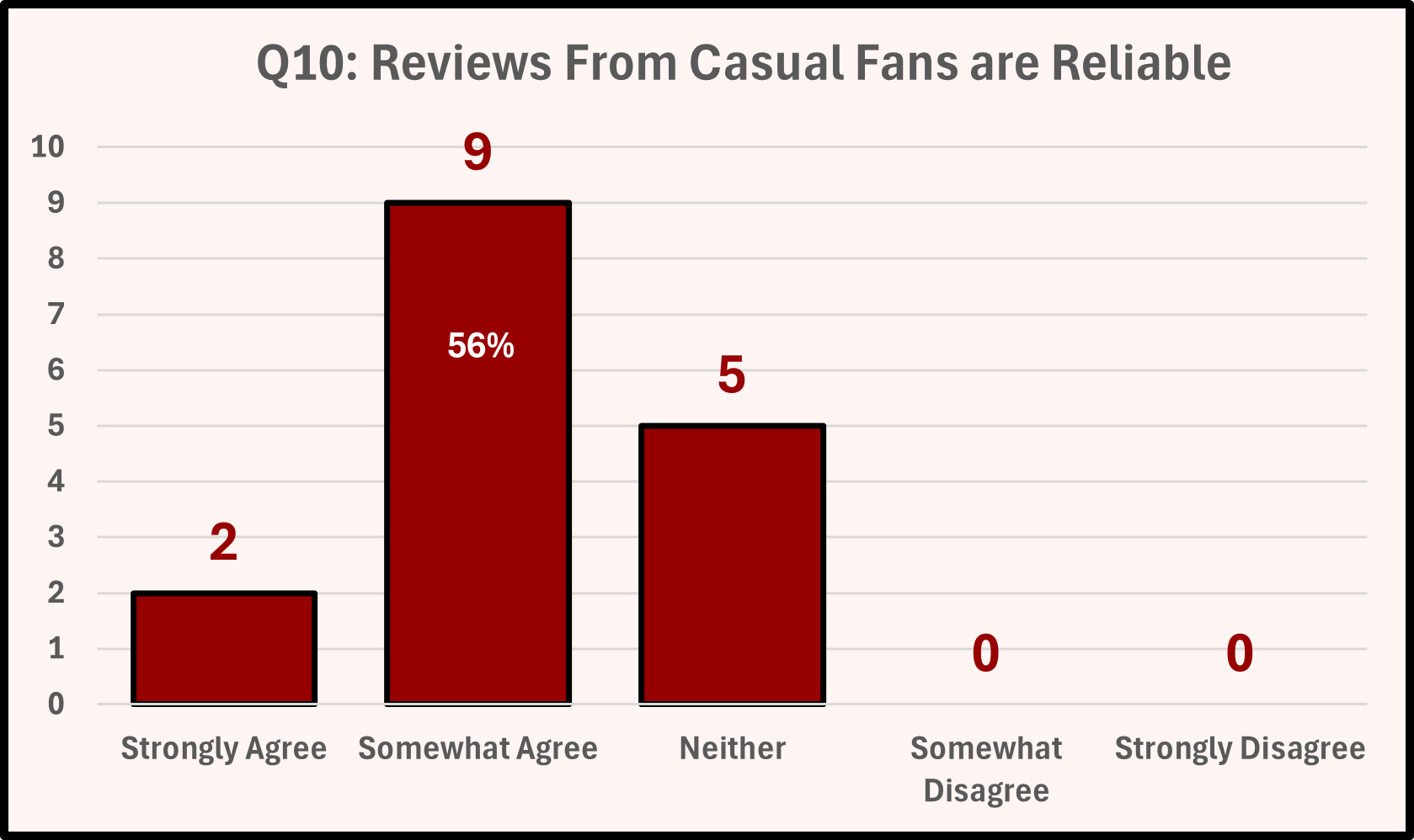

Question 10: Participants do trust reviews from casual fans despite their lack of professional knowledge (69%)

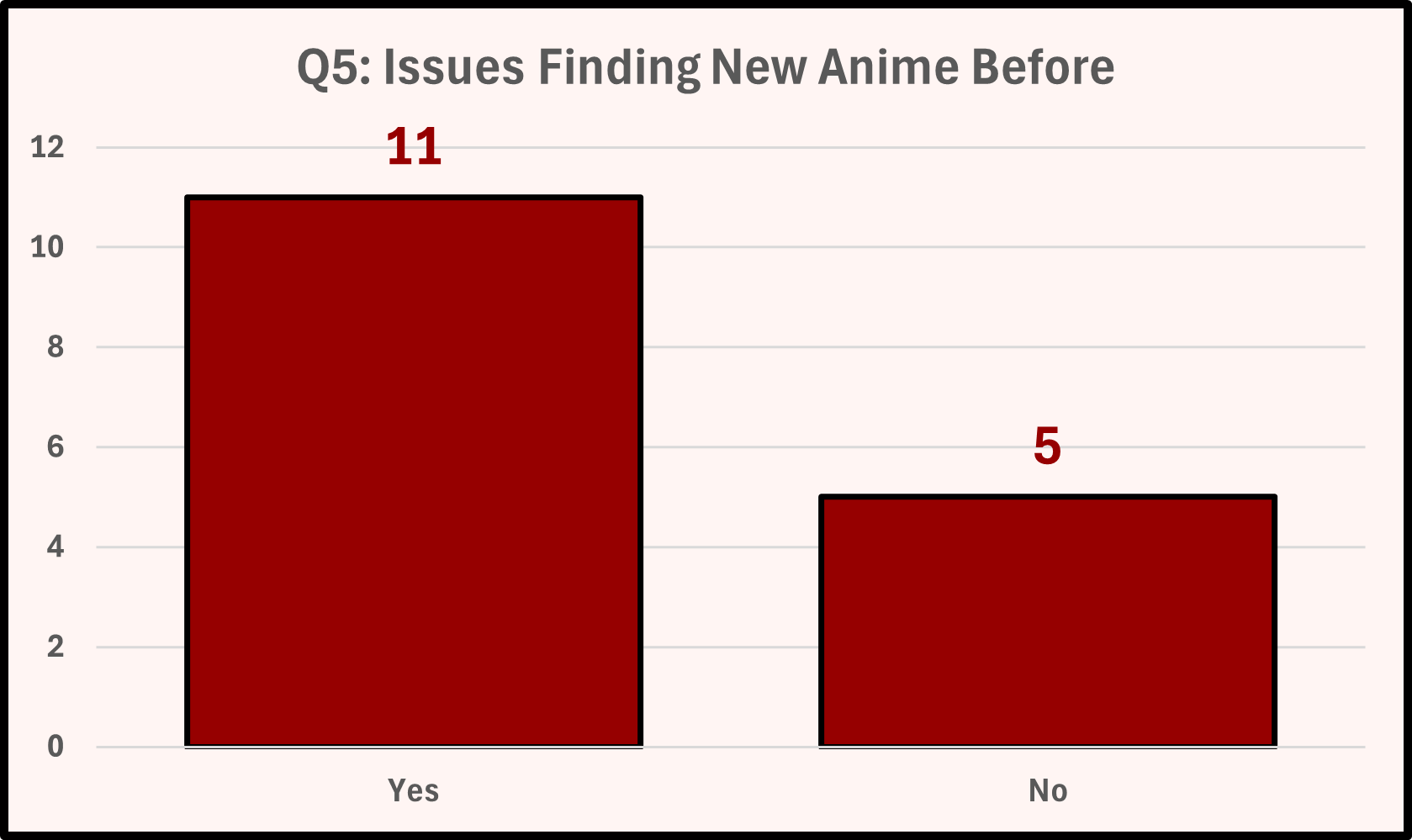

Question 5: 69% do have trouble finding a new anime.

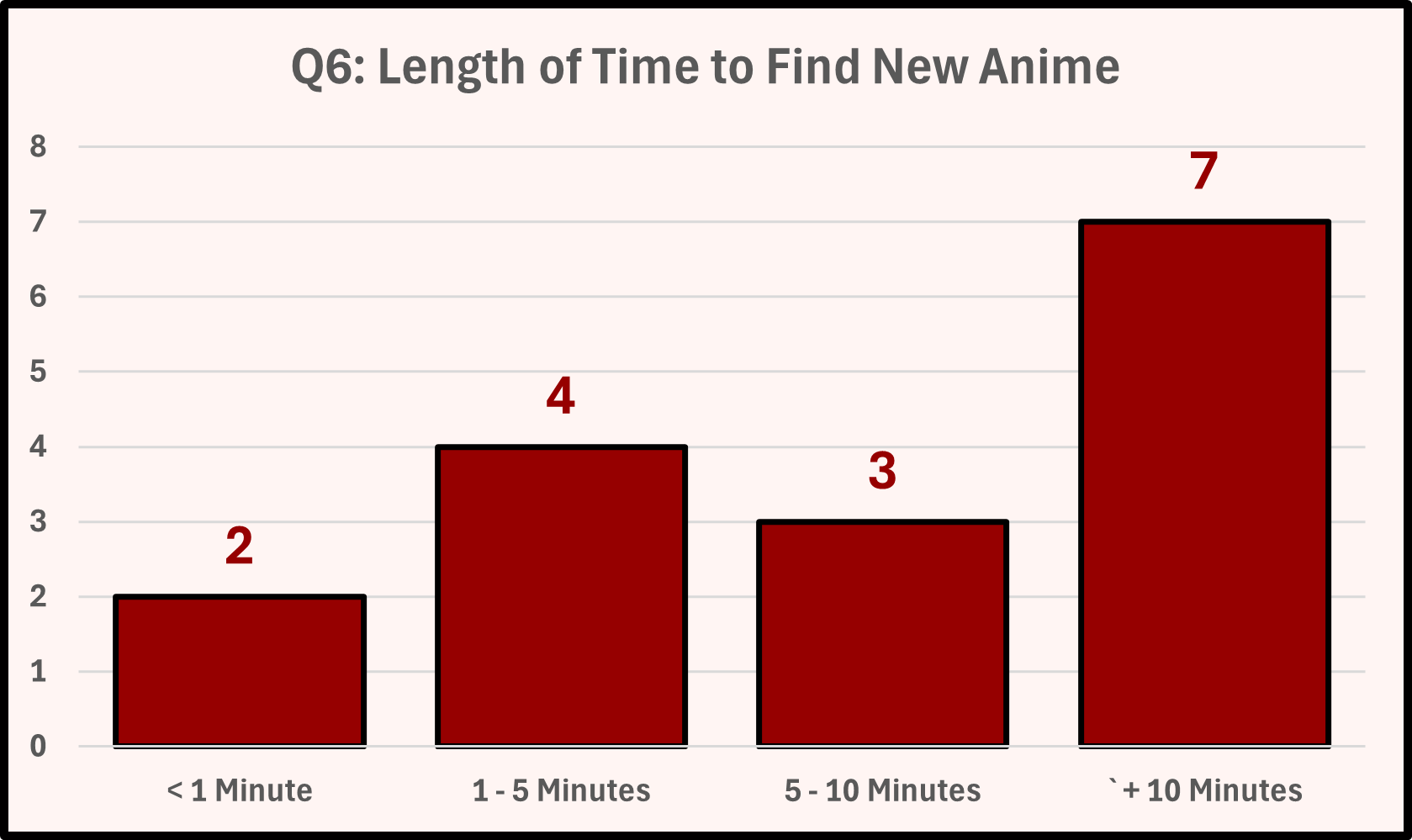

Question 6: More than half (63%) spend over 10 minutes searching for a new anime.

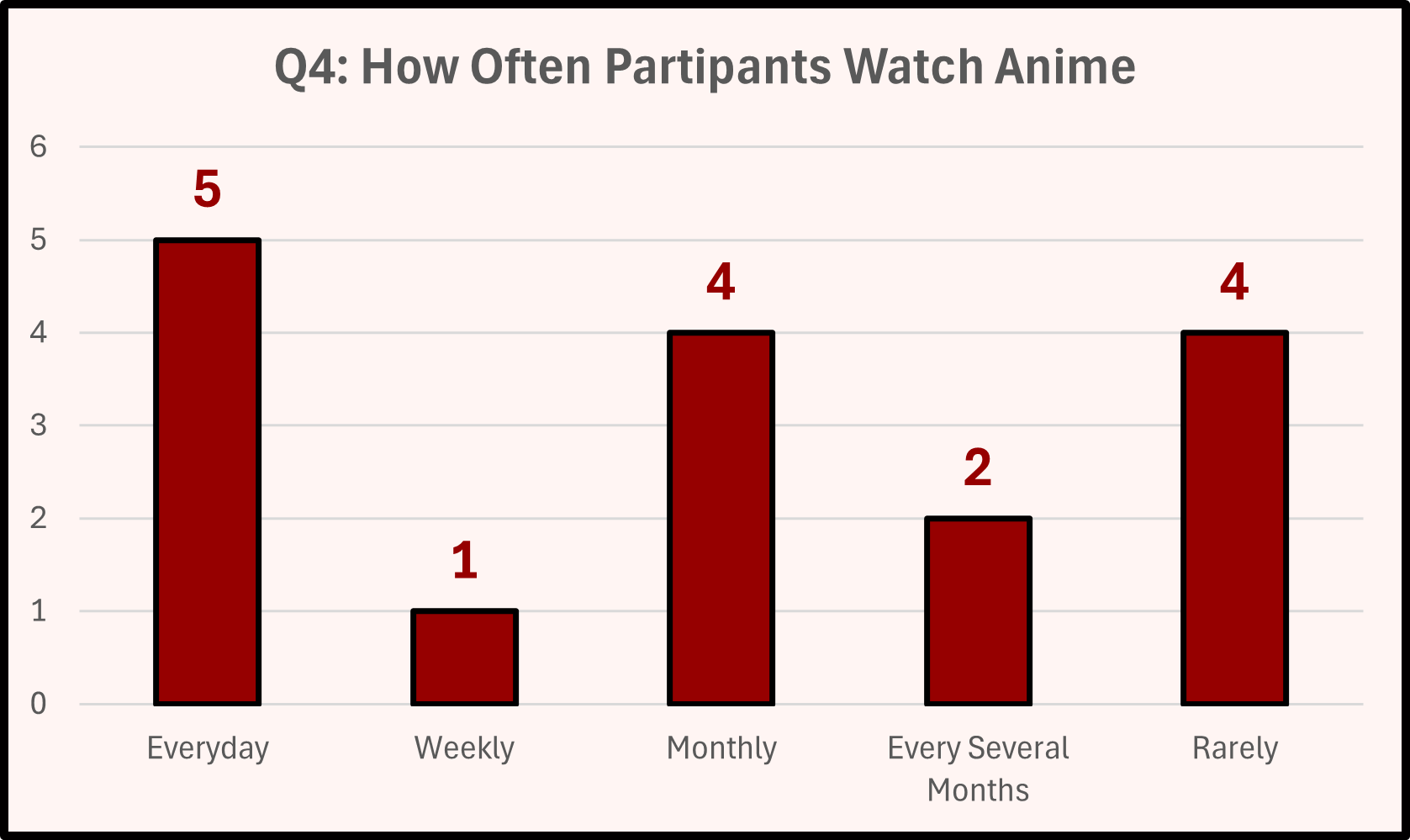

Question 4: 31% Watch daily, while 63% watch at least monthly

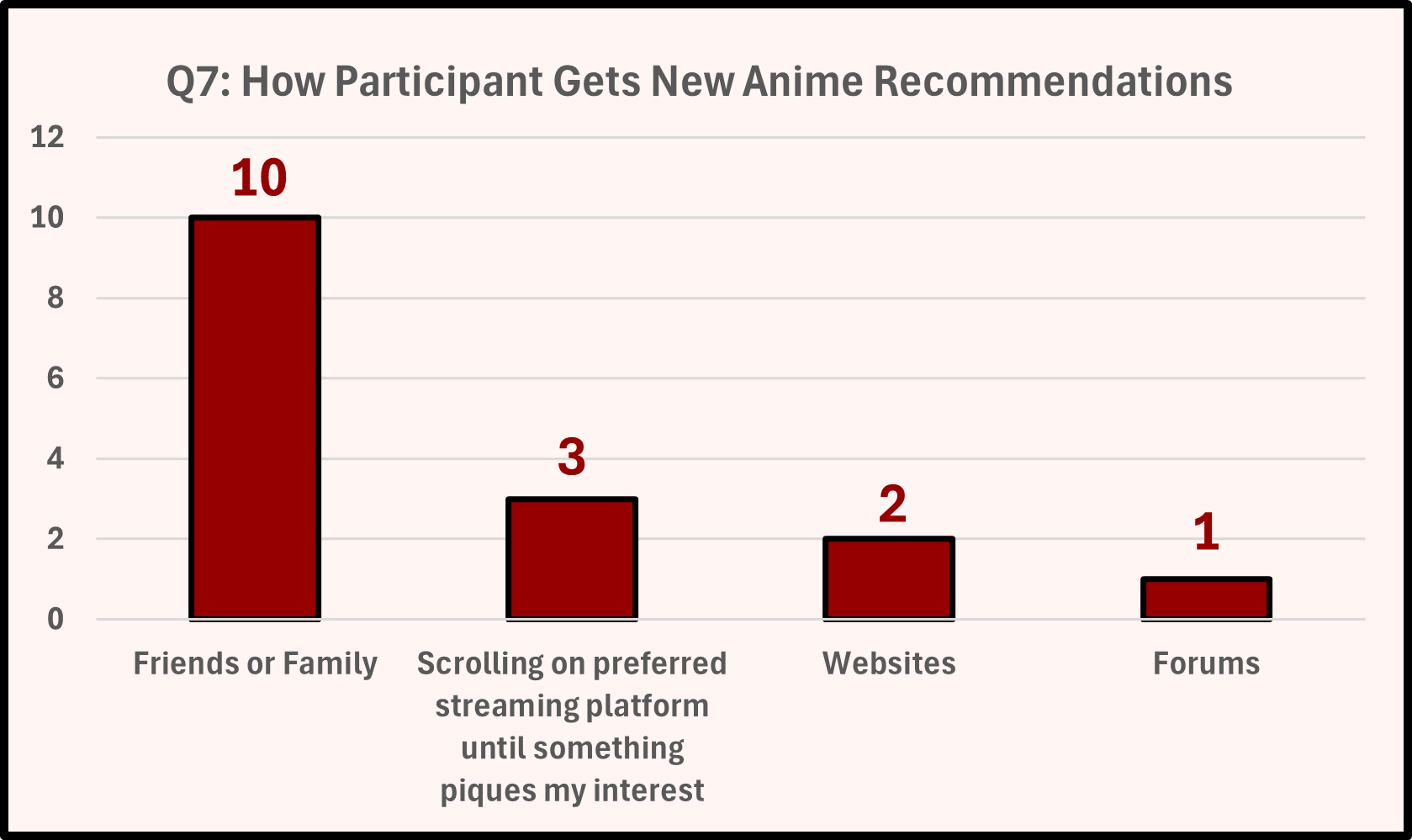

Question 7: 63% get their recommendations from friends and family

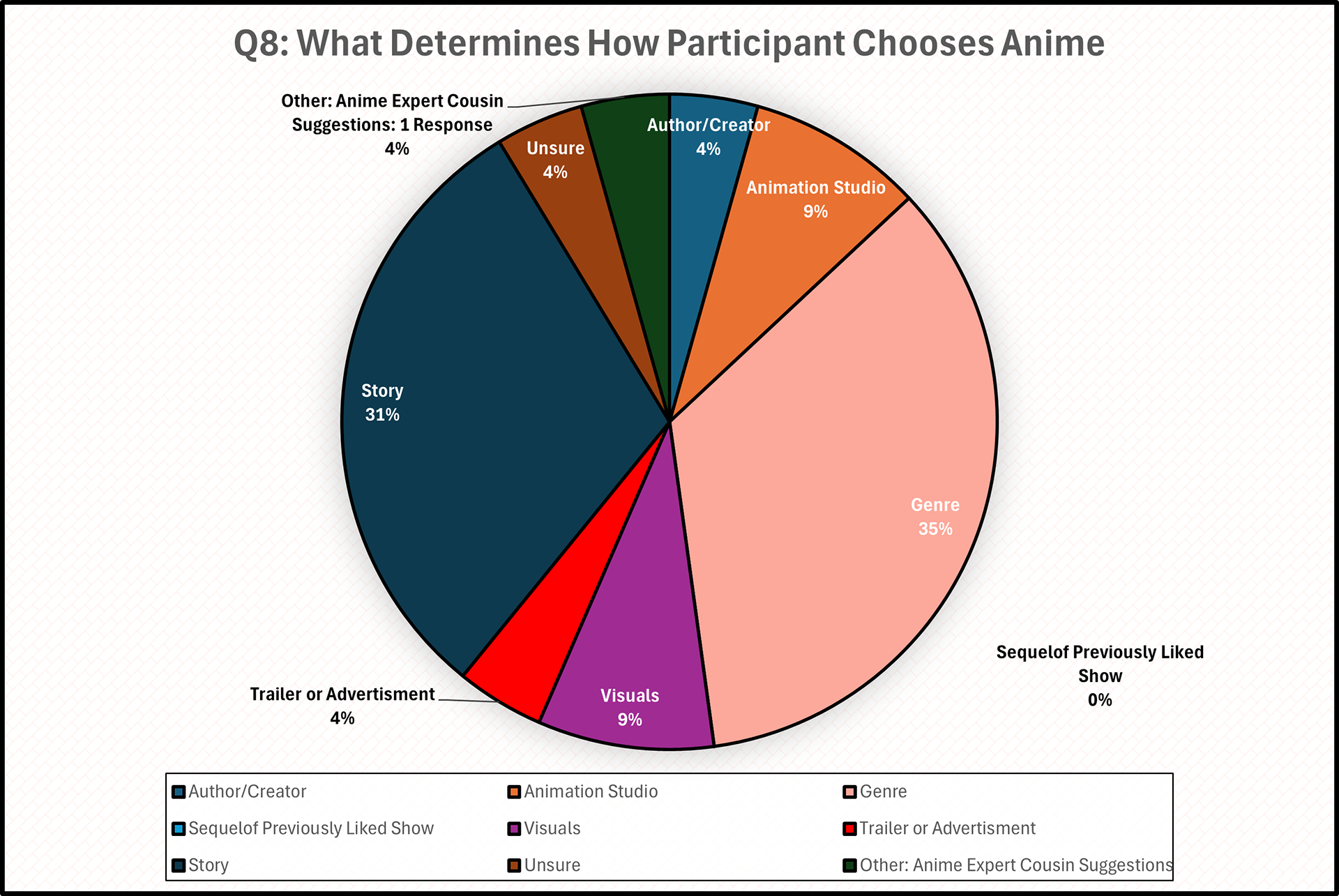

Question 8: Top Choice Determinants (could choose 2 options):

(1) Genre 35%

(2) Story 31%

(3) Animation Studio & Visuals tied at 9% (possible collinearity)

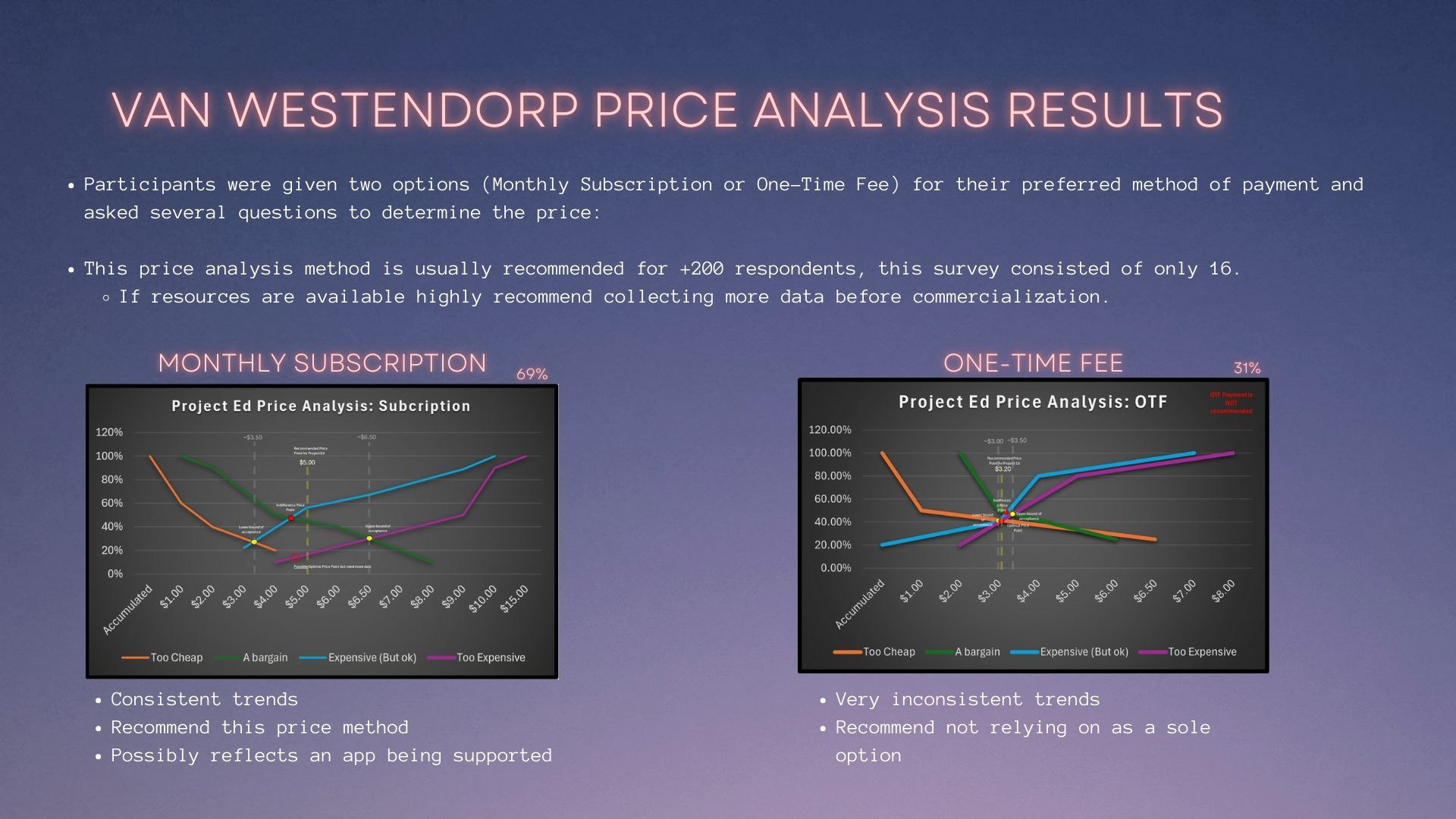

Van Westendorp Price Analysis

Structure:

Participants chose if they preferred a subscription option or a one-time fee option for this proposed app, then answered four succeeding questions based on this response.

Payment Options:

Monthly Subscription Option:

Clarity of crucial intersecting points: Upper Bound Lower Bound, and Indifference Price Point.

Did not have an intersection for Optimal Price Point but still gave a recommended price.

Favored option (69%), possibly due to the reflection of continuous support.

One-Time Fee Option:

Very inconsistent trends, and all crucial intersecting points are too close for reliable recommendations.

A recommended price was given but was not recommended as a sole method for payment.

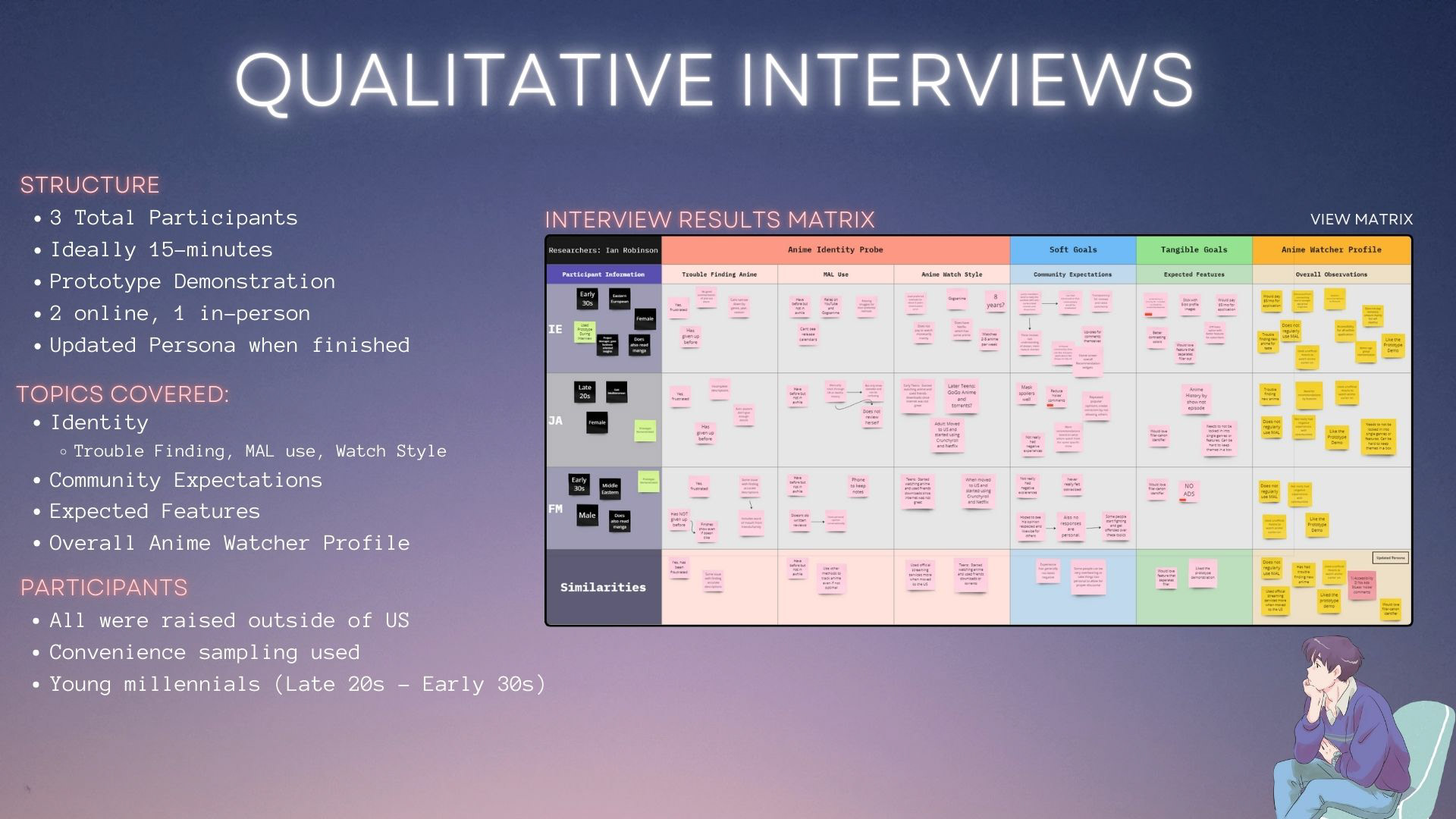

Interviews & Usability Testing

Process:

Qualitative interviews were conducted from convenience sampling (n = 3).

All participants, who were in their 20s, were international students in the U.S., but all have different countries of origin including Bulgaria, Lebanon, and Kuwait.

Notable Quotes Pulled to Help Develop the Main Themes:

“putting a filter that you can basically like filter everything. I want an anime launched in like winter of 2017”

(Explaining their ideal feature to fix a frustration)

(Explaining their ideal feature to fix a frustration)

“Not a good summary of the actual plot. Also not a really good representation of the poster of the anime.”

(When asked about the frustrations when searching for an anime)

(When asked about the frustrations when searching for an anime)

“Back home in [country of origin], we didn't have access to like streaming services.”

(When discussing how the participant watched anime in the past. Also highlights the importance of word-of-mouth)

(When discussing how the participant watched anime in the past. Also highlights the importance of word-of-mouth)

“I think it would be a good feature if you add manga in the app.

(When participant discusses features they would like to see)

(When participant discusses features they would like to see)

Qualitative Interview Affinity Matrix Check-it-Out

Top Feature Request For Each Participant:

(IE) Robust accessibility. This includes options outside of disability-oriented concerns such as language.

(JA) Less ‘noisy’ comments such as “I love this character” or surface-level, obvious statements. These can make comment threads chaotic and useless. Focus on comments that drive or push the conversation.

(FM) No Ads!!

Summarized Findings:

Anime Identity:

Trouble: Most descriptions are not accurate to their anime.

Watching: Initially used friends’ downloads or torrents since the internet was not reliable. Later on, used more official streaming services when moving to the U.S.

Soft Goals:

Community: Generally no negative experiences, but spam comments can be overbearing.

Tangible Goals:

Features: Enjoyed the current version of the prototype, but would like a feature that separates filler from canon episodes.

Summary Profile:

Watching: Used unofficial means to watch anime due to the lack of reliable internet before more commercialized streaming (2000s - 2010s).

Descriptions: Since descriptions do a poor job of informing the reader, do not limit searches to one identity, such as in a genre, since many incorporate several aspects.

The version used for interview demonstrations. The timeline for this development was appx. 1.5 weeks from planning to the current version.

Notable Features of Prototype:

Login: Most participants have not used MAL, so both an MAL sign-in and separate account options are available.

Direct Link: The prototype directly links to the user's preferred (legal) streaming platform, the trailer, or the MAL link.

Mirrored Description: Ratings and descriptions imported from MAL.

Aspect Recommendations: By genre, studio, story, or overall best.

Anime History: The participant stated other sites history are disorganized, this is for better record-keeping.

Presenting the Findings Check-it-Out

Recommendations

Survey:

Lifestyle: Ensure that word-of-mouth becomes the highest form of marketing long-term.

Searching for Anime: There is a need for reliable and accurate anime recommendations, so I recommend continuing with development.

Community: Maintain a self-sustaining ideology by relying on users to support their community.

Persona: Changed for a gender-neutral persona since equitable representation between genders. Also significantly reduced the amount watched per week.

Interview & Prototype:

Price Analysis: Use subscription pricing of $5/month. Collect more data since the recommended size is appx. 200 participants not 16.

Interviews: Do not rely so heavily on official streaming services or partnerships for markets outside of the U.S.

Prototype: Include accessibility options, filter out 'noisy' comments, and minimize ad use.